In the big stage of China's garment industry, traditional enterprises use "big fish to eat fish" as the rules of the game. These companies use various tricks to make themselves stronger. On the one hand, we must speed up the integration of production capacity using capital levers, staking in the country, and gain purchasing advantages, preferential policies, and finally complete listing through capacity advantages. On the other hand, upstream and downstream industries should be integrated to occupy the supply and market sectors. However, the new forces have embarked on a different path. They use the "fast fish to eat slow fish" as the rules of the game. They use the "light asset management" approach to slim down and light, to respond to market changes with ease.

Whether it is "big fish eat fish" or "fast fish eat slow fish", as long as enough "large", enough "fast", can stand firm in the apparel industry, hit a sky.

As long as a fulcrum, “light asset†enterprises can instigate the traditional clothing enterprises in the apparel market to achieve economies of scale through greater scale, it is understandable, but how do “light asset†companies compete with traditional apparel companies that have invested heavily? Occupy the clothing market? Archimedes once said, “Give me a fulcrum and I can shake the earth.†Then, where is the fulcrum of the asset-light enterprise to shake the apparel market? Let us first familiarize ourselves with "light assets" and "virtual operations."

Light asset is a relatively heavy asset that occupies huge funds. It includes the company's experience, standardized process management, governance system, brand, customer relationship, human resources, etc., and their production plants, production equipment, and raw materials. Compared with the use of less funds, it is light and flexible, so it is called light assets. On this basis, asset-light operations refer to the heavy asset management operations where companies retain light asset operations and need to spend large amounts of capital with low added value, or companies use their own light asset operations to obtain heavy asset operations in some way. Link. In fact, virtual operations and light asset operations are talking about the same thing, and their core is to use their own limited resources, leveraging the resources of other companies in order to fight for the largest return with the least investment. However, the subtle difference between "light asset operation" and "virtual operation" is that the former applies the idea of ​​light assets to a certain point in the operation of the enterprise, while the latter applies the idea of ​​light assets to multiple stages of the entire enterprise. In addition, the entire organization is given a larger choice, and the functions of some organizations are virtualized. That is to say, the degree to which the enterprise achieves sufficient "lightness" can be regarded as a virtual operation.

Through the above understanding, it can be seen that the “light asset†enterprises in China's garment industry have shaken the fulcrum of the apparel market as the core resource of “experience, standardized process management, governance system, brand, customer relationship, and human resourcesâ€. By effectively leveraging these resources, garment companies become lighter and more flexible after losing weight, accelerating their profitability.

When the virtual business encounters direct sales from the Internet, many companies reduce their investment through light asset operations or virtual operations, and concentrate their own resources on the highest profits in the industry chain to increase their profitability. For example, Nike, Adidas in the sportswear industry, Kodak in the camera industry, Dell in the computer industry, and ZARA in the apparel industry. These companies have achieved great success through asset-light operations and have become leaders in various industries.

Many domestic companies also enjoyed the benefits of asset-light operations. Mengniu was established in 1998. Its sales reached 1116 in the national same industry when it first entered the market, and ranked fourth in the same industry in 2002, with a period of four years to 1947.31. One of the important reasons why the growth rate of % has grown miraculously is the implementation of a light asset operating strategy. The most notable aspect of China’s garment industry’s virtual business is Metersbonwe. After nearly 13 years of development, Metersbonwe officially landed on the Shenzhen Stock Exchange on August 28, 2008. The doorman Zhou Chengjian and his daughter were worth as much as 10 billion yuan, and thus became the richest man on the rich list in the "Hurun Garments Rich List 2008". Zhou Chengjian took a road to asset management in a virtual business. He chose to outsource the production of the company, set up a sales network through franchising, and concentrated resources to create the core links of the value chain such as design and branding. Not only that, garment companies in Jiangsu and Zhejiang have gradually begun to accept this virtual business model, and some well-known brands such as Li Ning and Semir have gradually taken the path of virtualization. However, what these companies are currently doing is mainly production, product-level standard control and quality management. Compared with big international brands such as Dell and Nike, their brand-level R&D and design, brand communication, and sales channel innovation are still small. Larger.

So, what happens when virtual business encounters online sales? PPG and VENCL (Fanke Eslite) answered this question. They explained through practical actions how the virtual operation of the Chinese clothing industry is innovative. At present, they are the most "light" Chinese garment enterprises. Their main characteristics are: On the one hand, they adopt the virtual business model; on the other hand, they use innovative online direct marketing models. Let us first understand the basic situation of these two companies:

The approved batch of clothing (Shanghai) Co., Ltd. (PPG) was established at the end of 2005, the staff is only about 500 people, including 300 seats of the call center staff. PPG does not have physical stores, factories, and assembly lines. Using outsourced logistics and distribution, it sells shirts through the Internet and call centers. With more than 3 million pieces of sales, it has reached the top 3 among national shirt companies in just over a year. Due to the high cost of expansion, poor management of outsourcing processes, and incomplete business models, PPG operations have been sluggish. At the end of last year, it suffered a lot of negative news.

VANCL's Chinese name is "Vanke Eslite," which was established in October 2007. It was founded by Chen Sheng, the founder of the original Joyo.com, and was heavily invested in international venture capital. VANCL has made some changes based on the PPG model. The biggest difference between them is that VANCL uses the self-built logistics department to send goods, and sales mainly rely on networks. The annual sales volume of PPG that had just debuted surpassed that of China's garment industry leader Youngor's men's shirt for only three years, and VANCL announced that its sales have surpassed PPG when it was only established for 5 months. From this, VANCL is indeed Created a development miracle.

Following PPG and VANCL, some followers have followed the pattern of virtual business and online direct sales, hoping to create the same miracles as PPG and VANCL.

Youngor PK Vanke Eslite is one of the giants in China's traditional clothing companies, and one of the alternatives in China's apparel “light assets†company. No matter whether it is Youngor or Vanke Eslite, there is no doubt that they have achieved great success. At present, the two companies are examples of success. Let us take a look at their respective characteristics:

1. Business Operation Mode Youngor follows the development model of traditional clothing enterprises, from small to large, and steadily develops. It has the largest clothing production base in Asia. However, Youngor did not meet it. It continued to expand in the overall upper and lower reaches of the industrial chain. In the downstream of the industrial chain, Youngor spent a large sum of money to buy buildings in major cities to invest about RMB 7 billion to build 500 stores; in the upstream, Youngor established a joint venture company. Clothes dyeing and washing factory. At present, it already has a 500-mu textile industrial city for Fabric production and textile printing and dyeing.

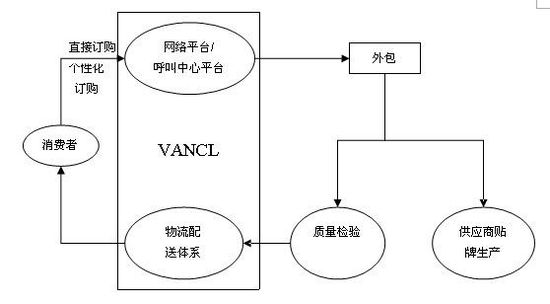

Vanke Eslite takes an extraordinary path combining light asset operation and online direct sales. There is no physical store, factory building or assembly line in any form. Product production and quality control are all outsourced to third-party companies, and only their own logistics are retained. Perhaps in the eyes of some people, this is a "bag company". Production and sales are given to Others. What day do people not cooperate with you? However, such concerns are somewhat redundant. After all, manufacturers with low thresholds for garment manufacturing will always be relatively surplus. As long as they control the most profitable links in the value chain - branding, marketing, etc., enterprises will always be in an advantageous position in the competition. .

Its operating model can be represented by the following diagram:

2, the company's development speed is also selling shirts, Younger since its establishment more than 20 years ago, step by step, and gradually become the leader of the shirt industry. However, after only a few months after its establishment, Vanke Eslite has surpassed Youngor's average daily sales, and its rapid pace of development makes people stunned.

3. The supplier management system Youngor integrates the supplier value chain into the enterprise value system through upstream and downstream integration to realize the self-sufficiency of the company's raw materials, which can save a lot of transaction costs and procurement costs, thereby enhancing the company's cost advantage and profitability. This is also a pattern adopted by many other traditional clothing industries. VENCL does not incorporate the upstream industry into the company's own business scope. It only captures the core concepts of the modern business model. Through a systematic and rigorous selection process, it only selects the best production suppliers for cooperation. Through rigorous supplier management system and strict quality control system, strict screening from the time of fabric selection, real-time monitoring of supplier's production process, and close to stringent quality inspection standards, strive to optimize the quality of VENCL products. .

4. Core competitiveness of the company Youngor invested heavily in establishing its own marketing channels and completed 2,200 stores, which is the country's largest marketing channel. Currently, this marketing network not only sells Younger's own suits, but also has foreign brands wanting to use these channels to enter the Chinese market. This has gradually become one of Youngor's core competitiveness.

The core competitive power of Vanke Eslite is its operating mode of asset-light operation and online direct sales. Vanke Espin has followed the example of PPG in the early stages of development. However, it does not completely duplicate the PPG model. Now it seems that it is better than blue and blue. At the time when PPG faced difficulties, Vanke Eslite had no weakness and became one of the most legendary companies in the apparel industry in 2008.

Source: Zheng Lie Management Consulting Consultant / Partner / Partner, Joint CEO Li Wei / Lü Mouzhu / Zhang Jiangyan

Clothes, Clothes Mentor,Clothes Rack,Clothes Stores

Clothes,Shoes,Bags Co., Ltd. , http://www.nbjacket.com